$9.7B in Red: Tancoo's Mid Year Review Exposes the Fiscal Reckoning Ahead

- The ValueCritic

- Jun 23, 2025

- 6 min read

Trinidad and Tobago's Mid Year Budget Review for FY2025, delivered by newly appointed Minister of Finance, Davendranath Tancoo, casts a stark spotlight on the government’s deteriorating fiscal position. The headline figure, a projected TT$9.67B fiscal deficit for the year. With the new administration in place following the 2025 general election, Tancoo’s mid-year intervention not only replaces but redefines the fiscal narrative, diverging from the Imbert-era assumptions. We covered T&T's deficit earlier on in the year highlighting the continuing decline in the country's fiscal positioning.Tancoo's review reaffirms these deep-rooted structural issues across the budget, debt servicing, reserves, and public investment, calling for both immediate accountability and long-term institutional reform.

The Tancoo Mandate: A Sharp Turn in Tone But Deteriorating Picture.

In his address to Parliament, Minister Tancoo, presented the review as a necessary correction to what he described as systemic imbalances and underreporting in the public accounts. He identified significant arrears, reportedly exceeding TT$1B in just the first half of FY25 and justified the request for TT$3.14B in supplementary expenditure as a measure to close existing funding gaps rather than initiate new programs.

Tancoo outlined shortfalls across major ministries such as education, health, and transport, attributing them to accumulated underbudgeting and procedural lapses. His review also introduced proposed institutional reforms aimed at increasing accountability, these include a forensic audit of transfer payments, reactivation of the BIR's enforcement division, and new procurement oversight mechanisms. While acknowledging the difficult fiscal environment, Tancoo emphasized the government's commitment to restoring fiscal credibility and rebalancing the macroeconomic framework in a deliberate and phased manner.

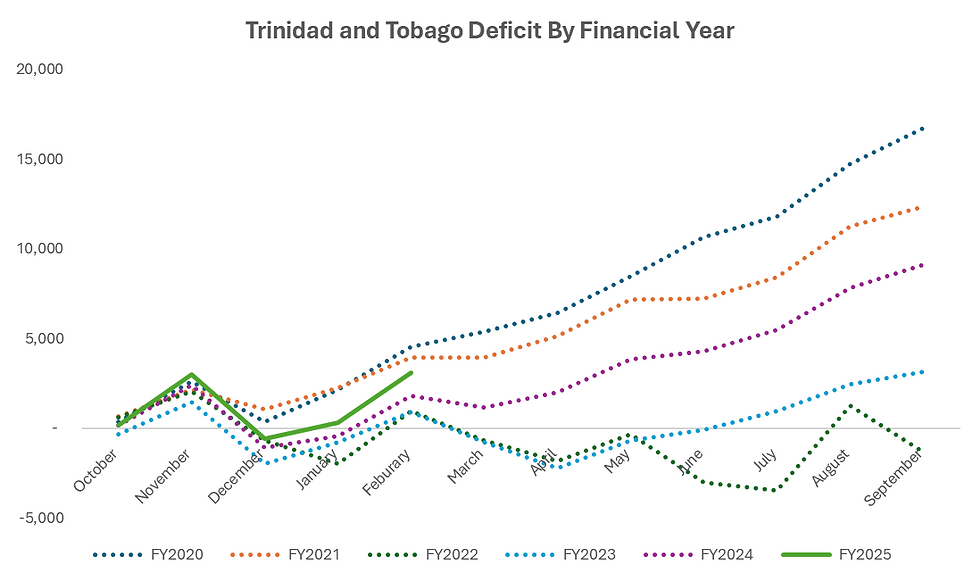

His projections show a far more rapid fiscal deterioration in FY2025 than in previous cycles. By the end of March 2025, the fiscal deficit had already reached TT$3B outpacing the timing of prior years. Historical data shows that in FY2024, the deficit only reached TT$3.8 billion by June. FY2023 was tighter still, with similar figures not appearing until September. This accelerated trajectory marks a significant departure from the pattern of gradual mid-year accumulation. The pattern mirrors, and in some months exceeds, FY2020’s pandemic-era deterioration, despite the absence of a macroeconomic crisis. The implication is sobering, T&T is moving toward record fiscal slippage in a non-crisis year (particularly as oil and gas have averaged near multi year highs).

The composition of expenditure reveals key pressure points:

Transfers and Subsidies remain above 50% of total spending, reflecting heavy social obligations. Tancoo cited arrears in education grants, public assistance, and housing settlements as driving near-term obligations.

Interest Payments now consume 11.2% of total expenditures, the highest in over a decade, with external debt servicing now accounting for over 25% of total interest costs.

Capital Expenditure remains subdued, averaging 6 to 8% of total expenditure, suggesting poor fiscal multipliers. Tancoo reaffirmed this constraint, noting that development spending was often delayed due to lack of cash flow and procurement gaps.

Wages and Salaries continue to hover between 17 to 18% of expenditures. While this ratio has remained stable, Tancoo warned that without improved revenue buoyancy or structural adjustments, public payroll obligations will become harder to maintain.

Source : Ministry of Finance

So what does this mean for government debt in 2025? The revised FY25 Estimates revealed that approx TT$10B will be spent on debt servicing, marking a significant increase from TT$7.6B in FY24. While part of this rise stems from maturing obligations, a growing share is linked to increased interest payments, rescheduling fees, and foreign exchange-linked servicing costs. Higher repayments on USD denominated loans and older floating rate bonds, coupled with resurgent principal maturities from past issues, are compounding repayment demands.

The MoF projects local principal repayments to rise by 92%, reaching TT$2.2B, while external amortization is forecasted to ease to TT$1.45B, though this figure remains highly sensitive to exchange rate movements and reserve buffers. The previous government also nearly exhausted its overdraft window with the Central Bank, drawing down TT$2.7B, and continues to roll over short-term Treasury bills to finance core expenditures.

With external debt now above 19% of GDP and internal debt approaching 39%, Trinidad and Tobago’s total public sector debt has surged to around 58% of GDP, a historically high level. This constrains policy flexibility and raises the risk of fiscal crowding out.

More alarming is the upward trend in interest payments as a share of total expenditure, which has climbed from under 6% in 2011 to over 11% today. This growing interest burden limits the state’s ability to respond to economic downturns or invest in strategic sectors like health, education, and infrastructure. Yield repricing has further compounded borrowing costs: local bond issuances in 2025 are now priced between 6.15% and 6.80%, reflecting global financial tightening and elevated risk premia. Without a corrective path, the debt-deficit-interest spiral could become self-reinforcing, potentially pushing the economy toward a point where debt servicing absorbs most of the country’s fiscal bandwidth.

The deterioration in net official reserves also serves as another warning for government fiscal positioning. Reserves have fallen from US$8.3B in 2021 to under US$6B in 2024, a decline that coincides with persistent current account surpluses. Why? Because net capital outflows continue to drain the balance sheet. These outflows, linked to portfolio investment, loan amortization, and external debt servicing, have consistently exceeded inflows, creating a liquidity mismatch that weakens the near-term resilience of the balance of payments.

Yet in contrast to the reserve drain, T&Ts Net International Investment Position (NIIP) is strengthening. As of September 2024, the NIIP stood at US$10.9B, an improvement of US$137.3M over the previous year. As a share of GDP, NIIP has grown from under 10% in 2019 to more than 35% in 2024. This upward trend reflects not only a reduction in external liabilities but also the continued accumulation of foreign assets through sovereign wealth funds and reinvested income abroad. In other words, while the government faces short-term liquidity constraints, the country’s external solvency is improving, giving policymakers a strategic cushion, provided it is carefully managed.

Feasibility of Tancoo's Policy Proposals and Transfer Reform

In his proposals, the finance minister laid out a broad reform agenda targeting transfer rationalization, foreign exchange transparency, and external competitiveness. He proposed implementing foreign currency reporting obligations for high-volume importers, profit repatriation protocols, and export-led growth incentives. These include tax exemptions, export retention facilities, and fiscal instruments to promote reinvestment of FX earnings into the domestic economy.

While the intent is sound and aligns with international standards (such as Barbados style repatriation safeguards), execution feasibility is mixed:

The creation of profit repatriation protocols and dividend safeguards will require bilateral treaty adjustments, tax code revisions, and cross-agency compliance monitoring (by getting rid of the TTRA this has become more difficult).

Proposals to implement a qualified minimum top-up tax, Global Forum compliance, and transfer pricing enforcement demand administrative capacity that is currently underdeveloped (will likely take sometime to develop).

Provisions like expanding international representation and an export proceeds retention facility are feasible but will require targeted institutional support and engagement from the Central Bank and Ministry of Trade.

On transfers, Tancoo pledged forensic audits and statutory reforms to better target spending. However, as discussed, much of Trinidad’s transfer spending is structurally embedded in fuel subsidies, social assistance, and statutory programs. The feasibility of rapid rationalization remains low given the potential for significant political backlash.

What likely to happen is that its implementation will be slow moving and capacity constrained. Phased rollouts and supported technical assistance may help, but fiscal consolidation through transfer reform will not occur in FY2025 and may not happen till FY2030 given the complexities of the issues needed to be addressed.

Despite the sharp rhetoric and technocratic framing, the FY25 Mid-Year Review reads more like a continuation of fiscal firefighting than a true structural pivot. Tancoo’s reforms are directionally sound, calling for improved transparency, targeted transfers, and a more coherent FX and tax strategy but their feasibility is undermined by entrenched fiscal rigidities and limited implementation bandwidth.

The deficit profile, debt servicing trajectory, and compressed capital spending suggest that the fiscal apparatus remains locked in a pattern of borrowing to meet recurrent obligations. With over 50% of expenditure still devoted to transfers and another 30% tied up in wages and interest payments, there is little space left to execute bold reform without external support or painful trade-offs. Meanwhile, the rising NIIP offers long-term comfort, but falling reserves and heavy near-term repayments are exerting tangible liquidity pressure.

Ultimately, the mid-year review signals that while the political guard has changed, the core fiscal machine continues to run on the same worn engine: under-collection, overcommitment, and rollover refinancing. Unless the second half of FY2025 delivers credible execution on reforms and a meaningful adjustment in the spending structure this strategy risks becoming business as usual, dressed in reformist language.

Comments