The Tariff Mirage: High Duties, Low Inflation

- The ValueCritic

- Jul 6, 2025

- 4 min read

Despite rising concern about a new wave of tariff driven inflation, the latest numbers suggest the US economy is absorbing the impact of trade policy changes far better than expected. In 2025, the US government had sharply increased tariffs on a wide range of imports, generating record breaking revenue. Customs duties are now being collected at a pace that annualizes to over $300B, as shown in the graph below.

This jump follows a broad expansion in tariff coverage, including a base 10% on most countries and additional increases targeting specific sectors. Monthly data show that the pace of collections has steepened since May 2025, a clear sign that the new tariff regime is now fully in effect.

Treasury Secretary, Scott Bessent, recently announced that the US had implemented a sweeping 10% baseline tariff on imports from over 100 countries. This is on the back of President Trump's announcing a conclusion to trade talks with Vietnam, offering details of a new trade deal with the country, requiring them to pay a 20% tariff on exports to the US and 40% on transshipped goods, while granting the US full tariff free access to Vietnamese markets. The intention seemly to disincentivize Chinese exporters (which are now taxed at 39% to 55%) from using other countries like Vietnam as transshipment hubs. These levies apply broadly, even to nations engaged in ongoing trade negotiations with the US with further hikes planned for countries not meeting the 10% baseline or not negotiating in goodfaith (according to Trump's recent statements), possibly setting up the stage for another tariff based disruption to equity markets later down the year.

However, given the current iteration of US tariff policy, the ETR is now projected to rise by as much a 14%, according to Goldman Sachs, a meaningful but more moderate shift compared to early projections of 20%+ from Liberation Day. However, other estimates from sources like Budget Lab (~9.7%), Fitch (~14%), and Allianz (~10%) suggests the US is settling around an an average estimated range of 10% to 12% . This marks a structural turn in US trade policy, but one that many economists argue is more manageable and less inflationary than initially feared,

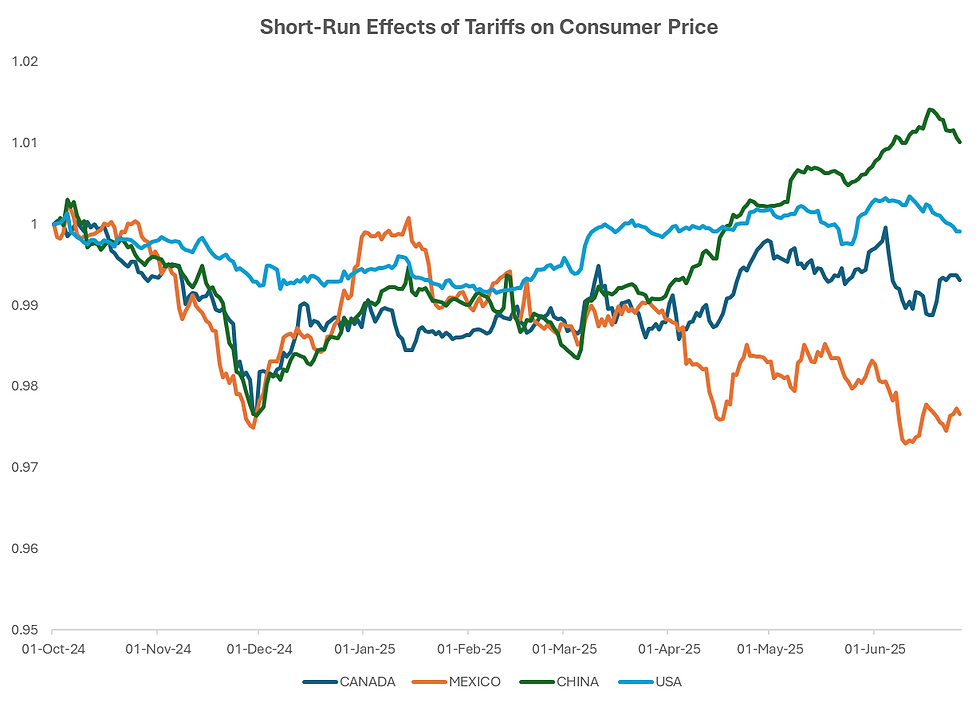

and many trade economists emphasis this. They note that while some firms may attempt to use tariffs as justification for price hikes, competitive market dynamics often limit their ability to do so. Firms face downward sloping demand curves and must weigh margin expansion against potential volume loss, especially when rivals are incentivized to maintain or lower prices to gain market share. Supporting this, Federal Reserve regional surveys show that manufacturers, unlike service firms, only partially passed on tariff costs, with a significant share absorbing between 20% to 50% of the cost increases. Other, more tariff exposed businesses are asking suppliers to bear the brunt of the costs with some supposedly being rebated any tariff related costs after purchasing (primarily from Chinese suppliers). Meanwhile, Pricing Lab, data confirm that inflation pressures remain concentrated in tariff affected imported categories and have seen notable declines since the recent policy adjustments. Imported goods, especially from China, have seen notable price increases since March 2025 (however have trended downward recently), while domestic goods and goods from countries with lower exposure (e.g, Canada, Mexico) remain stable or even deflationary.

Added to this, despite the historic spike in US tariff collections and a higher ETR, there is still little evidence that these trade frictions are spilling over into broad based inflation. Core inflation metrics, which strip out volatile items like food and energy, remain well anchored. Core CPI and Core PCE is expect to rise just around 0.24% and 0.22% MoM in July, respectively, while YoY readings are holding around 3.0% and 2.7%. Quarterly core inflation is tracking at a modest 2.6% annualized pace.

Market based measures, like the 5y5y forward rate, continue to hover near 2.3%. The fact that this measure continues to hover around 2.3%, even in the face of a sharp rise in tariffs and record customs revenue, signals that markets remain confident the FED will ultimately keep inflation near its 2% target over time. If investors believed tariffs would cause a sustained surge in prices, this forward looking rate would likely move higher, as it did during periods of inflation concern in 2021 to 2022.

Even real time private sector gauges such as Truflation suggest current inflation is already back below 2%. In terms of surveys, data from the UMich's long run expectations, which showed an early surge in 2025, has now fallen in both its May and June surveys. Together, these signals point to a broader dis-inflationary backdrop that remains intact, even as tariffs rise sharply. For now, firms appear to be absorbing costs or competing away the ability to pass them on, keeping inflation expectations and realized prices contained and within a manageable range. That dynamic is evident in import specific price trackers, which show rising prices on some imported goods, but little movement in domestically produced or unaffected categories. In short, while tariffs have sharply lifted trade taxes and import costs, the inflationary impact has been more nuanced than feared. Price increases are concentrated, not systemic. With the Fed signaling little change to its long run rate outlook and core inflation drifting near target, there is little evidence yet of a re-acceleration that would justify dramatic market repricing. As always, policy execution, trade retaliation, and consumer behavior will be critical in shaping the downstream effects in the coming quarters. For now, the data suggest a tariff regime that is fiscally active but macroeconomically muted.

Comments